A credit score assesses your creditworthiness. When you apply for a loan or a credit card,

lenders look at your credit score first. It gives them an idea of your ability to repay the

borrowed amount. As a result, maintaining a high credit score is critical.

Credit bureaus in the country calculate a credit score based on several factors such as payment

history, credit exposure, credit mix, credit inquiries, and credit history length. Unknown to

many, a credit score can be anywhere between 300 and 900.

Lenders generally consider credit scores of 750 and above to be ideal. As a result, you should

always strive for a credit score that is close to 900. Let’s look at the importance of having a

good credit score.

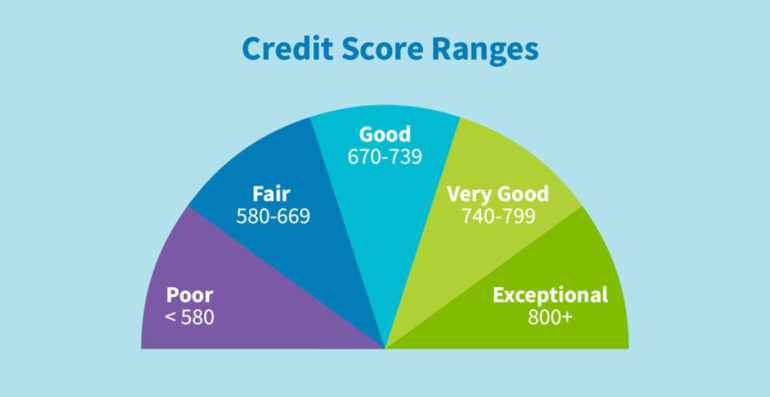

Credit score ranges

Creditors set their own standards for what scores they will accept, but the following are general

guidelines:

A score of 720 or higher is generally considered excellent credit.

A score between 690 and 719 is considered good credit.

Scores between 630 and 689 are fair credit.

And scores of 629 or below are poor credit.

In addition to your credit score, creditors may consider your income and other debts when

deciding whether to approve your application.

Importance of Maintaining a Good Credit Score

Makes you eligible for loans- Having a high credit score qualifies you for loans and credit cards.

A good credit score indicates that you have been repaying your debts and are knowledgeable

about credit. It will give lenders a good reason to lend to you because you are unlikely to

default.

Credit cards- A high credit score will help you get a credit card with better rewards and

benefits, in addition to loans. With a credit score of 750 or higher, you will be able to obtain

credit cards that are appropriate for your needs.

Lower interest rate – One advantage of having a good credit score is that banks may offer you a

lower interest rate on your loans. Given your repayment history, you have a good chance of

receiving interest rate reductions on loans.

Higher credit card limits- Having a good credit score will not only get you a lower interest rate

on your credit cards and loans, but it will also help you get a larger loan amount. In contrast, a

low credit score will result in a lower credit limit. A high credit score indicates that you can

manage credit well, and banks may consider offering you a credit card with a higher credit limit

as a result.

Quicker loan approvals – Several lenders offer pre-approved loans to consumers with a long

credit history and a high credit score. One of the most significant advantages of having a high

credit score is that banks will approve loans more quickly. Your loan application is approved

immediately, with no waiting period.

Enhances the value of a visa application – A high credit score gives your application for a visa

good weight. When you apply for a visa in most countries, such as the United States or the

United Kingdom, your income tax records are taken into account. As a result, a good credit

score could give the visa application a boost.

For the future- Even if you do not intend to apply for loans or credit cards in the near future,

maintain a good credit score or credit history. A good credit score will help you in the future

when you apply for home loans, personal loans, credit cards, or any other type of loan. It is

always preferable to have a credit history because it allows lenders to assess your

creditworthiness.

Bottom line

Because there are numerous advantages to having good credit, such as access to better credit

cards and lower interest rates, it’s critical to understand how your credit habits may be helping

or hurting your credit score.

You’ll be able to take advantage of all of the positive financial opportunities associated with

good credit once you understand how to get a good credit score.

For more details please visit –

http://rahejagroup.co/

or contact :(+91) 8225811300, 07712424100 )

Plots in Raipur | Flats in Raipur | Most trusted builders of Raipur | Real estate developer in Raipur

| Residential property in Raipur | Real estate company in Chhattisgarh | Raheja group